Tips To Reach Your Homebuying Goals in 2023 [INFOGRAPHIC]

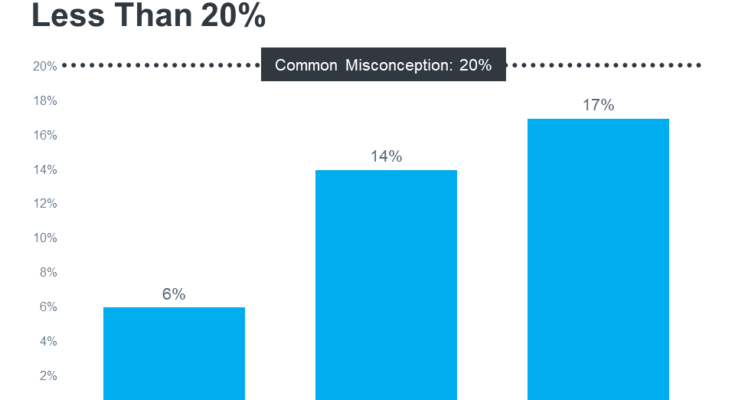

Some Highlights If you’re planning to buy a home in 2023, here are a few things to focus on. Work on your credit and save for a down payment. If saving feels like a challenge, there’s help available. Then, get pre-approved, create a list of desired features, and prioritize them. …

Tips To Reach Your Homebuying Goals in 2023 [INFOGRAPHIC] Read More